"Suburbanization" and Detroit's Davison & Banglatown Neighborhoods

Something caught my eye while working on research for a series on changes in Detroit property ownership over the last five years. It’s a little too narrow a topic for that series, so I wanted to share it separately.

A Few Cities Where Ownership of Detroit Property Appears to be Growing

I’ve been looking at changes in the number of Detroit properties for which ownership appears to lie in a Michigan city other than Detroit. This analysis is based on point-in-time snapshots of property tax bill mailing address data from 2018 and 2023 Detroit tax rolls.

Perhaps surprisingly, across the twenty Michigan cities where the largest number of Detroit properties appear to be owned (again, excluding Detroit-based ownership) tax bill mailing address data doesn’t offer much evidence of a significant change in overall Detroit property ownership since 2018. In fact, ownership of Detroit property in many cities appears to be flat or declining:

That’s interesting on its own, but what caught my eye was a few of the cities where ownership totals did show an increase:

Warren (+14%)*

Hamtramck (+17%)*

Sterling Heights (+13%)

*There are limitations on the use of tax bill mailing address data as an indicator of where ownership sits. There’s a discussion of those at the end of this piece. The asterisks above account for some changes in tax bill mailing addresses in those cities that are not relevant to, and would artificially inflate, the particular phenomenon I want to discuss here so I’ve removed those properties. The revised growth figures for the cities above, which are lower than the figures in the table, reflect that. Again there’s further explanation of this at the end of the post.

Upon seeing the growth in those three cities I immediately recalled a portion of a 2021 report, “Building Inclusive Cities,” published by Global Detroit. The following is from a conversation with a focus group of immigrants from Bangladesh who live in the Detroit neighborhoods Banglatown and Davison, both areas with significant immigrant populations:

“‘There is not one of us who doesn’t think about [moving to the suburbs] all of the time.’ It was noted that a Bangladeshi community has begun to emerge in Macomb County, principally in the city of Warren. Among the attractions of the suburbs mentioned were larger houses, more room for parking (both off- and on-street), better schools, lower property tax and insurance rates, and less crime. Crime, notably, was not high on the list, reflecting the perception (and reality) that Banglatown/ Davison is a reasonably safe area.” - Building Inclusive Cities, page 58

Anecdotally, I know that Warren, as mentioned in the Global Detroit report, and Sterling Heights are popular cities to move to from Detroit for portions of the Davison and Banglatown immigrant communities. As Davison and Banglatown both sit on the Hamtramck border, there is likely plenty of movement between the neighborhoods and that city, too.

Obviously people can move to a new city without owning property in the city they left. By looking at changes in tax bill mailing address I am in no way suggesting that much more than a sliver of population movement, if any, can be captured. But I would be very interested to know if the increase of Detroit properties for which ownership appears to sit in Warren, Sterling Heights, and Hamtramck reflects some level of movement from the immigrant community based in Davison and Banglatown and / or increasing ownership of Detroit property based in the immigrant communities in those cities.

Other Elements of Property Ownership Seen in Tax Bill Data

There are other angles to look at tax bill mailing address data that, in addition to the overall changes in tax bill destinations, make me curious about how the sentiments captured in the Global Detroit report might be manifesting on the ground today.

There is a high concentration of Detroit rental properties for which ownership sits in Davison and Banglatown. The heat map I made below (which you can open in fullscreen here) shows concentrations of Detroit rental property that is owned by someone in Detroit based on where the property tax bill is mailed. You can see Davison and Banglatown, just north of Hamtramck, called out as having a particularly high concentration of ownership of Detroit rental properties. If you aspire to move to the suburbs, owning income-generating rental property would certainly be a supportive step in that direction.

You may be able to see the movement of some ownership out of Davison and Banglatown specifically and into the suburban cities mentioned above in tax bill data. There are about 275 properties in the 48212 zip code (which includes Davison and Banglatown) that had their tax bills mailed to an address in that zip code in 2018 and, today, have their tax bill mailed somewhere outside the city. Of those 275 properties, 67% now have their tax bill mailed to Hamtramck, Warren, or Sterling Heights. No other city has more than a single-digit share of tax bill destinations. That’s not a huge number of properties in a zip code with over 11,000 Detroit parcels, but the concentration of tax bill movement into those three cities is interesting.

Immigrant Enclaves and Detroit

I don’t want to suggest a decline in either the overall population or immigrant population alone in Banglatown and Davison. New residents can of course move in to replace those who leave. And property ownership can move without former property owners moving, too. More research would need to be done to figure out what’s behind these tax bill mailing address changes than I can discern with the data I have.

Judging by the continuing high occupancy, low tax delinquency, and substantial rehab and repair activity in Banglatown and Davison, I see no current indication of decline of any kind.

However the Global Detroit report notes the dissipation of immigrant communities in Detroit is a risk and something that has happened before in areas like northeastern Detroit and its one-time Hmong community — and that’s far from the only example. Moreover, the report points to the Davison and Banglatown immigrant communities as particularly susceptible to “suburbanization”:

“Ironically, we see the threat of suburbanization greatest in Banglatown/Davison, if only because of its parallels with many similar immigrant enclaves throughout American history. Such enclaves are a particular response to immigrant insecurity, and as a result, often represent transitional communities which tend to decline as the immigrant population becomes more firmly established, and even more as the more acculturated children of the immigrant generation reach adulthood and form families.” - Building Inclusive Cities, page 58

The Success of Banglatown and Davison

There has been incredible progress in Davison and Banglatown (not to mention other Detroit neighborhoods with large immigrant communities, like Springwells Village, Chadsey Condon, and more) over the last ten years or so. Vacant homes are much more difficult to find now than they were ten years ago. That’s not because of demolitions, it’s because once-vacant homes have been rehabbed and reoccupied. Commercial corridors are active. Property tax delinquency is low. All of this is discussed at length in the Global Detroit report.

Across many of the criteria government measures success in Detroit, these neighborhoods are succeeding. But that success, per residents of the areas included in the Global Detroit report, is happening in spite of government efforts not because of them:

In none of our conversations, however, was local government, or any public sector entity, seen as critical to [immigrant] decisions to settle in a neighborhood, stay or leave that neighborhood, or achieve success in their efforts to pursue the American Dream. Immigrant respondents were largely disconnected from government and had extremely low expectations of what government could accomplish for them. - Building Inclusive Cities, page 58

Intersections with the Property Tax System

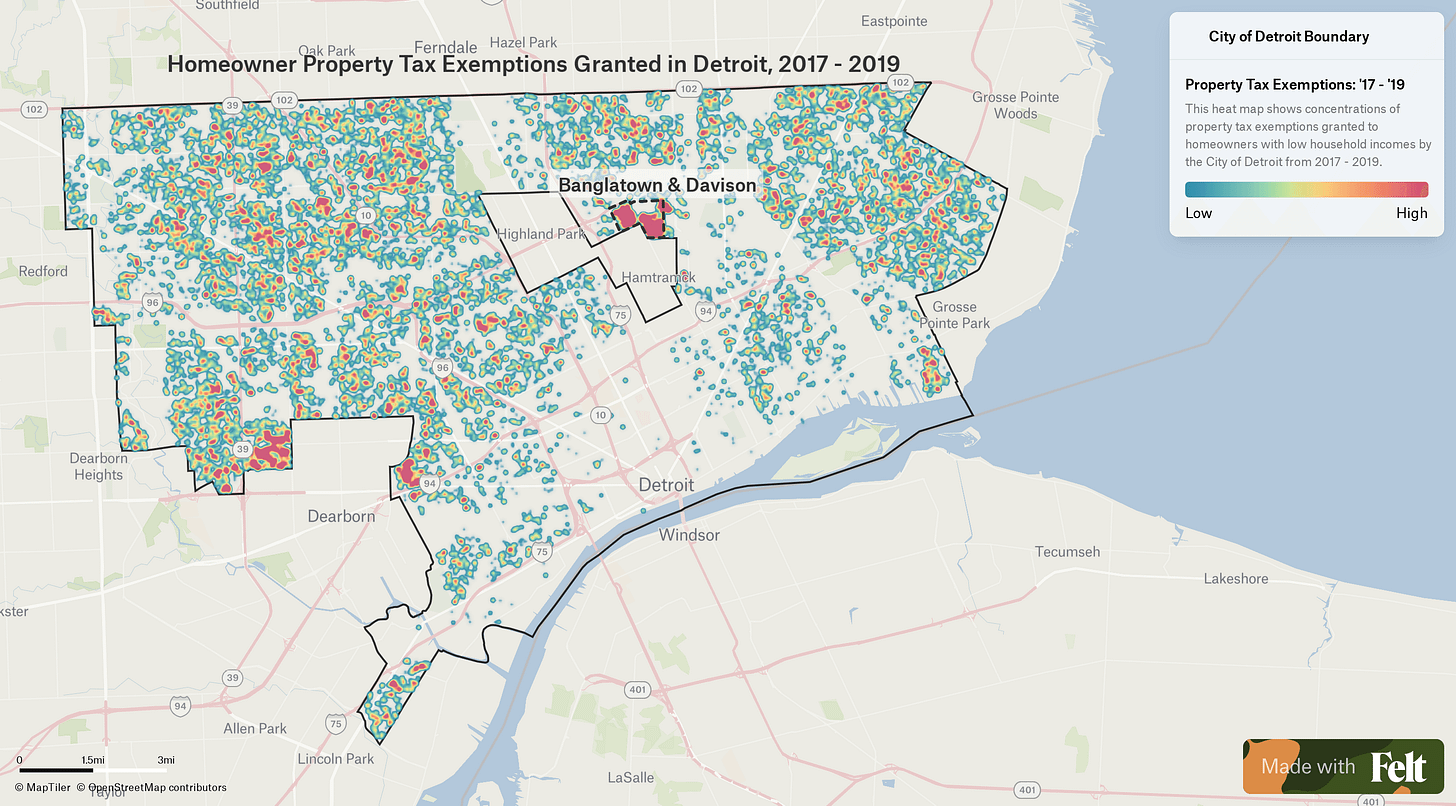

One area where I have worked at the intersection of the immigrant communities in Banglatown and Davison and local government is the property tax exemption application process. The Homeowners Property Tax Exemption (HOPE) from the City of Detroit eliminates the current year’s property taxes and unlocks the ability to eliminate tax debt too for homeowners with low incomes. I worked on increasing the number of exemptions granted, and the power of those exemptions. They are crucial tools for Detroit homeowners with low incomes to stay in their homes.

For years, HOPE was a notoriously difficult and lengthy application to complete. If English wasn’t your first language, or a language you spoke at all, the application was even harder and likely not possible to complete without direct assistance.

Despite this, between 2017 - 2019 which were the first three years I was extensively involved in HOPE applications, the Davison and Banglatown neighborhoods consistently produced the largest concentration of HOPE applications in the city. As a direct result, the neighborhoods also had some of the lowest tax delinquency rates in the city.

Fortunately, as a result of diligent reform efforts within certain corners of city government, the HOPE application has gotten much easier in recent years. In 2020 or 2021 (I can’t recall which) the application was also translated in Arabic, Spanish, and Bengali for the first time (though it still needs to be completed in English).

I thought I’d mention one potential opportunity for the City of Detroit to possibly make progress on a few things at once in Davison and Banglatown. Consider these four factors:

Demand for the HOPE property tax exemption in the neighborhoods is high.

There is a significant concentration of rental homes owned by people in the neighborhoods.

The Global Detroit report cites high property taxes as at least one factor in residents’ rationale for leaving Detroit.

Residents report having “low expectations” for what government can accomplish for them.

Given all that, I think there could be an important opportunity for the City of Detroit to make the case for its Land Value Tax proposal within these communities. An average homeowner property tax reduction of 17% would benefit homeowners in the community, and I suspect landlords of single family home rental properties would see a reduction in their properties, too. Though a land value tax would benefit the whole city, it would also speak to specific concerns from these neighborhoods.

More Questions Than Answers (from me at least)

I don’t want to draw any particular conclusions from the data I’ve presented because it all raises more questions for me than answers. But I do think that, between the insights of the Global Detroit report, which is fantastic throughout, and the hints seen in the data above, there’s something worth understanding here.

Aside from the land value tax mention, I don’t want to claim any particular expertise as to what should be done to provide more support to those communities and a reason to stay in Detroit. The Global Detroit report offers some ideas and with far more experience in those communities than I have. But I would hate to see those communities dissipate and want to at least advocate for using the tools and data available — along with the kinds of thoughtful conversations featured in the Global Detroit report — to try to better understand the decisions that are being made in those communities on an ongoing basis, and why.

Limitations of Tax Bill Mailing Address Data as an Indicator for Ownership

Where a property tax bill is mailed can be helpful for figuring out where ownership of a property sits but there are some important limitations:

It’s not necessarily going to help you unpack LLC and / or corporate ownership. Just because a tax bill for an LLC is mailed to, say, Southfield, doesn’t mean ownership lies in Southfield. It could just be some law firm, property management company, or resident agent service that just receives mail. The LLC owners could be based somewhere else entirely.

Sometimes, a mailing address is just a mailing address. Tax bill addresses can move without ownership moving in a meaningful way. Returning to the asterisks I’d included earlier, when highlighting a few cities with increases in Detroit property ownership:

“That’s interesting on its own and I think might be surprising to some people. But what is especially interesting to me are a few of the cities where ownership totals DID increase:

Warren (+14%)*

Hamtramck (+17%)*

Sterling Heights (+13%)”

In Warren, a portion of the increase in Detroit properties owned came from Crown Enterprises — the firm associated with the Moroun family. The Detroit properties now owned by Crown Enterprises are those extracted from the City of Detroit as part of the land swaps required for the Jefferson North expansion several years ago. It was a large enough chunk concentrated in one owner clearly not associated with the phenomenon I wanted to discuss that I removed those properties from the calculation of the %-increase in Warren so as not to suggest a larger growth in ownership than warranted.

In Hamtramck, on the other hand, it does not appear that any change in ownership took place for some of the Detroit properties whose tax bills are now mailed to the city — it just looks like a change in tax bill mailing address was made. The properties I did not count in the increase there are owned by Matthew Tatarian, a well-known speculator of Detroit property.

A tax bill address can change without ownership changing, and sometimes ownership will change without a tax bill address changing. A change in tax bill mailing address does not necessarily indicate a change of ownership (as mentioned above). On the flip side — and especially relevant in Detroit — sometimes ownership changes but the tax bill mailing address does not. One reason can simply be a lag in record keeping or failure to update records. But also not uncommon in the Detroit rental market are landlords that continue to have the tax bill mailed to the address of the property they own (more on that in the series to come).

Given all of the above limitations, I also looked at changes in tax bill mailing address destinations differentiated by type of ownership, separating out businesses from individual owners. When looking only private individual ownership (not LLCs or other corporate entities) I still saw the same changes in tax bill mailing address changes, with Warren, Hamtramck, and Sterling Heights at or near the top of tax bill mailing address increases.