Detroit Home Values Are Up, Why Isn't Property Tax Delinquency Down?

Six months since my last deep dive into delinquent tax data, I'm not encouraged by the trends

Detroit may be outpacing Miami in home price gains, but that fact is not producing lower rates of property tax delinquency in the city.

Last August I pointed out a 10% increase in property tax delinquency for Detroit homeowners vs. the same time in 2022 — the first such increase for homeowners after years of progress reducing & eliminating tax debt. At the time, I said this about the increase in homeowner delinquency:

“The increase in homeowner delinquency could disappear by this time next year. Maybe, for some unknown reason, homeowner delinquency post-delinquent transfer in 2023 is taking longer to ‘settle down’ and the increase seen as of August will evaporate in the coming months. But the penalties in the tax foreclosure system are strongly weighted against ‘assuming the best.’ Overreaction is always the best bet.”

Fast forward six months, and tax delinquency data paints a worrying picture. Not only has the delinquency not waned, it seems to be part of a concerning pattern.

While some fret about hypothetical increases in tax delinquency amongst vacant land owners under Detroit’s land value tax proposal, I’d suggest there’s a lot more to gain by taking steps that would address the tax delinquency that actually exists within occupied homes.

Here’s the situation in several charts I put together thanks to delinquent property tax data collected by Regrid from the Wayne County Treasurer, and 2023 tax roll data from the City of Detroit:

Detroit’s Declining Median Property Tax Debt Isn’t As Good As It Seems:

At first glance the chart above might seem reassuring. Yes, the number of delinquent properties1 citywide circa January 2024 is up a bit (6%) vs. the same time last year, but the median delinquent tax debt is much lower, and thus should be easier to pay off. But, to me, this just begs the question — why is the median tax bill so much lower? The answer isn’t reassuring:

Because a lot of properties are newly delinquent that haven’t been in years prior.

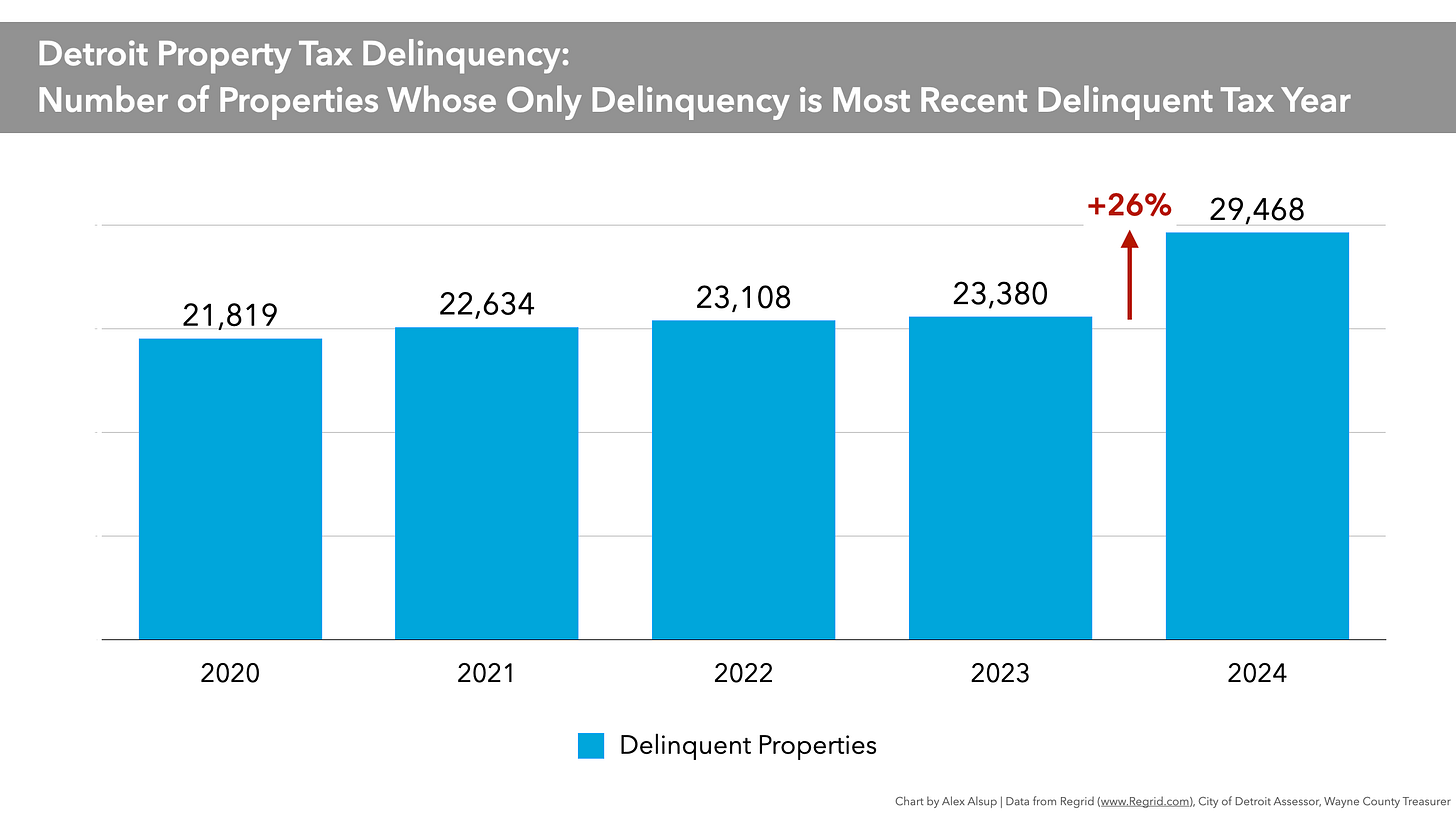

The Number of Newly Delinquent Properties is Up 26%:

As of January 2024, properties with unpaid 2023 taxes are not yet tax delinquent2. So what we’re looking at above are the number of tax delinquent Detroit properties whose only property tax delinquency, as of January 2020 - 2024, was the most recent delinquent tax year — in our case, that’s the 2022 tax year.

50% of Detroit properties that are tax delinquent as of January 2024 only owe delinquent property taxes for the 2022 tax year.

Those 29,000+ properties represent a 26% increase over the number of apparently “newly delinquent” properties as of January 2023. That means these are not properties saddled with lots of legacy debt, stuck in the delinquent tax system year after year — they appear to be newcomers to this degree of tax delinquency.

Which leads to the obvious next question: What are these properties, and how does the mix of property types compare to newly delinquent properties in years prior?

8 in 10 Newly Delinquent Properties are Occupied Homes:

Strikingly, the mix of newly delinquent properties circa January 2024 is almost identical to the mix of newly delinquent properties as of January 2020 — about 80% are occupied homes, and renter-occupied homes outnumber owner occupied homes.

Remember that the chart above does not tell us that more homeowners are tax delinquent overall in January 2024 than were in January 2020 — it tells us that there are more homeowners whose only delinquency is the most recent delinquent tax year (2022 as of January 2024) than there were in January 2020.

As of January 2020, there was much more legacy debt in the system — properties that had multiple years of tax delinquency, all owed simultaneously. In the years since, there’s been tremendous progress eliminating tax debt, particularly for homeowners. The hope, of course, is that once legacy tax debt is eliminated properties will stay out of delinquency moving forward. What we’re seeing is some evidence of a backslide. It’s not a tidal wave of catastrophic proportion, but it’s enough to warrant serious attention now.

The trends thus far don’t suggest it will go away on its own.

Properties Are Exiting Tax Delinquency at the Lowest Rate in Five Years:

While I can’t look at 2023 property tax delinquency yet, I can get a sense of which way the tide of tax delinquency is going by looking at the change in the number of delinquent properties from August to January (the two delinquent snapshots I’ve been working with) for each of the last five years.

What the chart above shows is that the rate of decline in the number of tax delinquent Detroit properties from August 2023 to January 2024 was -14.8% — the lowest rate in the five years for which I have data. In other words, Detroit properties are exiting tax delinquency more slowly than in recent years. It’s not a total collapse by any means, but it’s not encouraging.

What Does This All Amount To?

When I discussed rising delinquency last August I didn’t have a great sense of why it might be happening. I still have more questions than answers, but here’s what I’ve gathered so far:

There’s an Issue with Detroit Homeowners Getting HOPE Property Tax Exemptions

There are 5,400 homeowners who owe delinquent property taxes for 2022 and did not owe any delinquent taxes across any of January 2020 - 2023. In other words, their current delinquency does indeed appear novel. Of those 5,400 homeowners, 1,950 (36%) received a HOPE property tax exemption due to poverty in 2017 - 2021.

It’s very unlikely that many homeowners stopped being eligible for the HOPE exemption in that time. Much more likely is that there is still a misunderstanding amongst homeowners that they need to reapply every year. This is likely especially confusing given that during the pandemic the HOPE was indeed automatically carried over on a one-time basis.

Homeowners falling back into delinquency after having received a HOPE exemption is unacceptable. Receipt of a HOPE one year should trigger concerted efforts in following years to support reapplication.

It’s Not The Real Estate Market

Rising home values and inflation can also produce higher assessments and tax bills, but there’s no indication that’s what is behind this delinquency.

While assessments can rise and fall as much as market values dictate in Michigan, changes in taxable value, on which taxes are actually calculated, are capped at the lesser of 5% or the rate of inflation unless there is a sale. In Detroit, taxable values are generally low, and this delinquency isn’t found amongst properties with recent sales:

The median taxable value on newly delinquent occupied single family homes is $11,300 (which translates to ~$790 / year tax bill for a homeowner, $1,000 / year for a landlord) which is slightly lower than the citywide median taxable value for an occupied single family home, which is $11,750.

Landlords Are Falling Behind on Taxes, Too

Perhaps more surprising to me than homeowners’ delinquency (where I’m well familiar with issues within programs like HOPE) is the fact that landlord delinquency is also up against a backdrop of rising property values. I’d expect as values rise landlords might be more proactive about protecting an appreciating asset and avoiding the tax delinquency system, but it hasn’t happened.

I called an out of state landlord who owns a couple dozen tax delinquent single family home rental properties scattered across Detroit. It was a call out of the blue, but I told him I wanted to get his take and he agreed to talk with me on condition of anonymity.

When I told him about the City’s land value tax proposal that would reduce taxes on occupied homes he was stunned. “How could the mayor support that? I was just in Detroit — they can’t even plow the streets. Why would they do anything that gave them less money?”

I explained how little the revenue is represented by property taxes, and made my typical case in favor of the land value tax proposal, but he was still skeptical. I asked why the taxes on his homes were delinquent and if something new had caused it, but he said no.

“Taxes in Detroit are notoriously high. I always have to pay them in arrears — I can’t keep up. It’s just getting harder and harder there. I have to think about selling properties in the future. 36th District Court is just letting people stay. They don’t want to hold anyone accountable for rent. People get in and two months later they stop paying rent.”

The City’s rental ordinance, which has very low compliance, was also a major issue.

“The day they come for that is the day I start selling properties. Everything they do has a counter reaction from the landlords. If you screw us, we’re just gonna keep raising rents. I wish there was a landlord advocacy group — I would gladly join. We’re always the bad guy.”

In a few weeks unpaid 2023 property taxes will transfer over to the Wayne County Treasurer from Detroit. It will take a couple of months for the delinquent transfer to settle down and the picture of unpaid property taxes from 2023 to become clear. I’m not optimistic we’ll see a significant reversal of the tax delinquency trends above. I think if a reversal were coming we would see some acceleration in the rate of properties with 2022 delinquency having eliminated that debt between August 2023 and today, but that hasn’t been the case.

All property types, debts >$300 to eliminate waste fee delinquency which is not a tax and not foreclosable.

As defined by having had their delinquent city taxes transferred to the county treasurer for collection, which happens on March 1st each year.

Great work, Alex. Very informative.

My take on tax delinquency...

Delinquency goes down when property values not only go up, but are at rates that are high and sustained. By high I mean, houses are selling in area far above what a reasonable person would say they are worth.

I realize people buy into real estate at different time and value troughs.

To explain, a long stable urban city neighborhood with prevailing 5 year average legit transaction value of $80k starts in thus market sustaining $145k. Reasonable person who is not upwardly mobile but lives on same community and has witnessed the sustained uptick thats our person.

In that $80k sustaining $140k, delinquencies will usually decline. Why? Because that real estate now has diverse risk investment ready to buy it at any sign of distress, including at tax sale.