Speculators Win Big in Michigan Supreme Court Ruling

Michigan Supreme Court Rules that Rafaeli "Windfall Profit" Decision Applies Retroactively

This warrants a longer post than I have time to write today, but, as I’ve covered this story extensively, I wanted to send out a brief update:

Today the Michigan Supreme Court issued a ruling in Schafer v. Kent County that their decision in the 2020 case, Rafaeli vs. Oakland County, does indeed apply retroactively:

That means property owners who saw their properties sold in tax foreclosure auctions across Michigan prior to the 2020 Rafaeli decision are eligible to take steps to recover any “windfall profits” generated by the foreclosing county treasurer.

Put simply:

If a property you owned in 2015 was tax foreclosed for a debt (taxes + interest, penalties, and fees) of $3,500 and subsequently sold at auction for $7,500, you could now seek to recover that $4,000 of “windfall profits”.

The same applies, importantly, if you owned a portfolio of properties in 2015.

Here's just a tiny fraction of what can now be pursued by owners of multiple tax foreclosed Detroit properties from just the 2015 tax auction and the total windfall profits they can now, presumably, pursue from Wayne County:

What it Means:

For Speculators and Landlords

This seems to be a stunning gift to speculators, landlords who “milked” properties in cities like Detroit (collecting rent from dozens of homes while providing no upkeep nor paying taxes), and, in general, some of the very worst actors of the tax foreclosure auctions.

You can read much more about why those are the primary beneficiaries in two pieces I published on this topic a few months back — one is in the Brennan Center’s State Court Report and the other was an op-ed that appeared in the Detroit Free Press and also ran here in The Chargeback.

For Former Homeowners in Detroit

I received a good question from a reporter wondering what this would mean for Detroit homeowners who lost their homes as a result of overassessment.

My response was that I think anything like a systemic benefit is highly unlikely and I've seen little evidence to suggest there would be one.

The thing about overassessment in Detroit is that, as a lot of research has shown, it’s the least valuable homes that were overasssessed the most. While that is certainly likely to increase the risk of tax foreclosure, it’s not going to mean anything to the market actors deciding what to pay for that property at auction. That means those homes are unlikely to see high sale prices & windfall profits generated.

Additionally, an overassessed homeowner would likely only see an opportunity for windfall profits on one property whereas a speculator or landlord could see opportunities on many properties.

For Wayne County

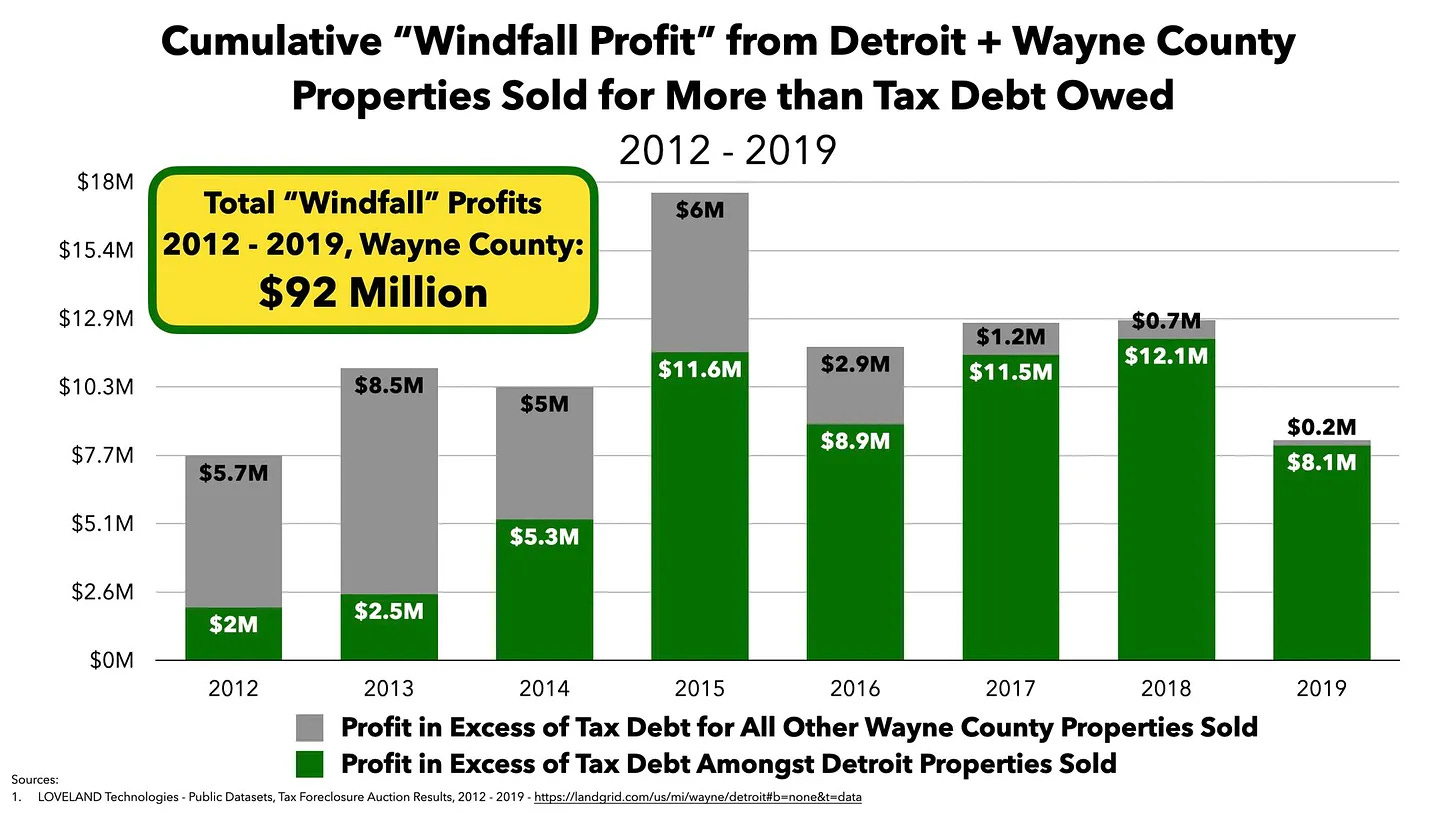

I’ve previously estimated the windfall profit liability for Wayne County for the 2012 - 2019 tax auction years (which is where I have sufficient data to make an estimate) at $92M:

The tax auctions, however, started in 2002 so that is far from a complete picture. If the total windfall profit liability for the county wound up more in the range of $150M - $200M, I wouldn’t be surprised.

What I imagine comes next are a lot of lawyers looking for clients with windfall profit cases they can bring agains the County. Of course, it is going to be the speculators and landlords that are most organized, interested, and able to profit from such an endeavor.

Will Wayne County be able to absorb the financial demands that could come out of that? Will other Michigan counties? We’ll see.