In Michigan Supreme Court Ruling on Tax Foreclosure Profits, Speculators Would Win -- Again

If the Michigan Supreme Court decides their ruling in Rafaeli applies retroactively, it won't be former Detroit homeowners who benefit

A version of this piece appeared as an op-ed in the Detroit Free Press today.

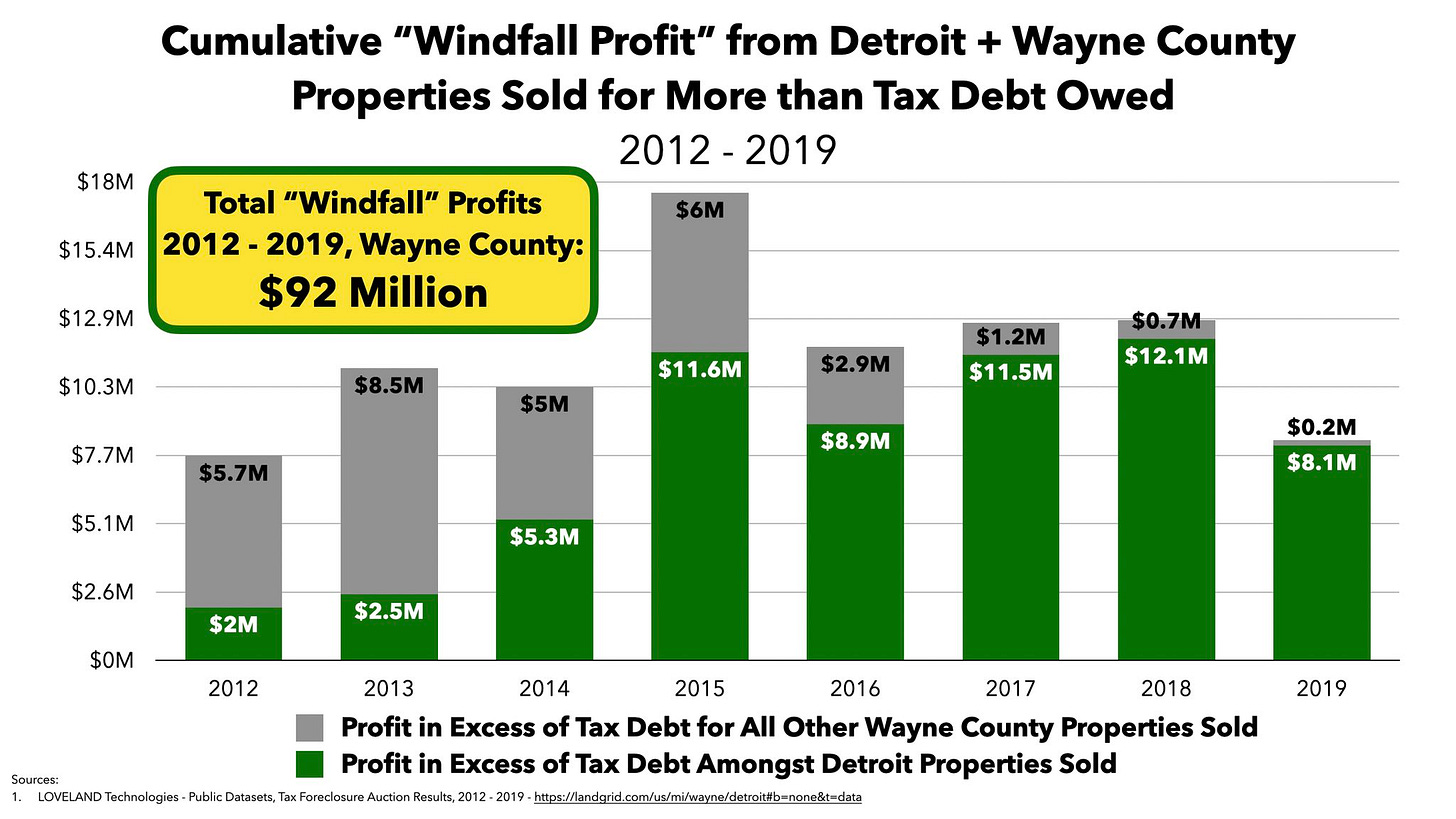

Recently the Michigan Supreme Court heard arguments concerning whether or not their 2020 ruling in the Rafaeli v. Oakland County tax foreclosure case was retroactive1. It’s an important decision. If the Court rules Rafaeli is retroactive then Michigan counties need to repay property owners whose properties were tax foreclosed and sold at auction for more than the tax debt owed between 2002 - 2019, prior to the Rafaeli decision. Tax sales in excess of tax debt owed generate what are known as a “windfall profit”, which the original Rafaeli ruling found unconstitutional for county treasurers to keep.

Contrary to what one might assume, if the Michigan Supreme Court decides that Rafaeli v. Oakland County applies retroactively, at least in Detroit, it will primarily benefit speculators and landlords, not former Detroit homeowners.

How is that Possible?

The decision would require Michigan counties to refund the surplus from tax foreclosure auctions generated when properties sold for more than the tax debt owed. In Wayne County, I’ve found that figure would be $92 million for tax auctions from 2012 and 2019, meaning the total for all tax auction years prior to Rafaeli (2002 - 2019) would be far higher.

Detroit homeowners, as I’ve documented extensively, lost tens of thousands of their homes to tax foreclosure. But a ruling finding that Rafaeli applied retroactively would not provide financial restitution to the overwhelming majority of those one-time homeowners.

Here’s why:

Most Detroit homeowners lost their homes at a time when auction prices were very low and it’s unlikely much in the way of windfall profits were generated.

Auction prices have risen in recent years and, thankfully, the number of homeowners at auction has dropped to almost nothing. That means, however, where there are increasing instances of windfall profits it’s not coming from owner occupied housing — it’s found amongst speculators and landlords who often owned portfolios of tax foreclosed property.

It will be a Sisyphean task to find the former Detroit homeowners, to the extent they exist, who might be owed retroactive windfall profits.

1. Fire Sale Auction Prices in 2015

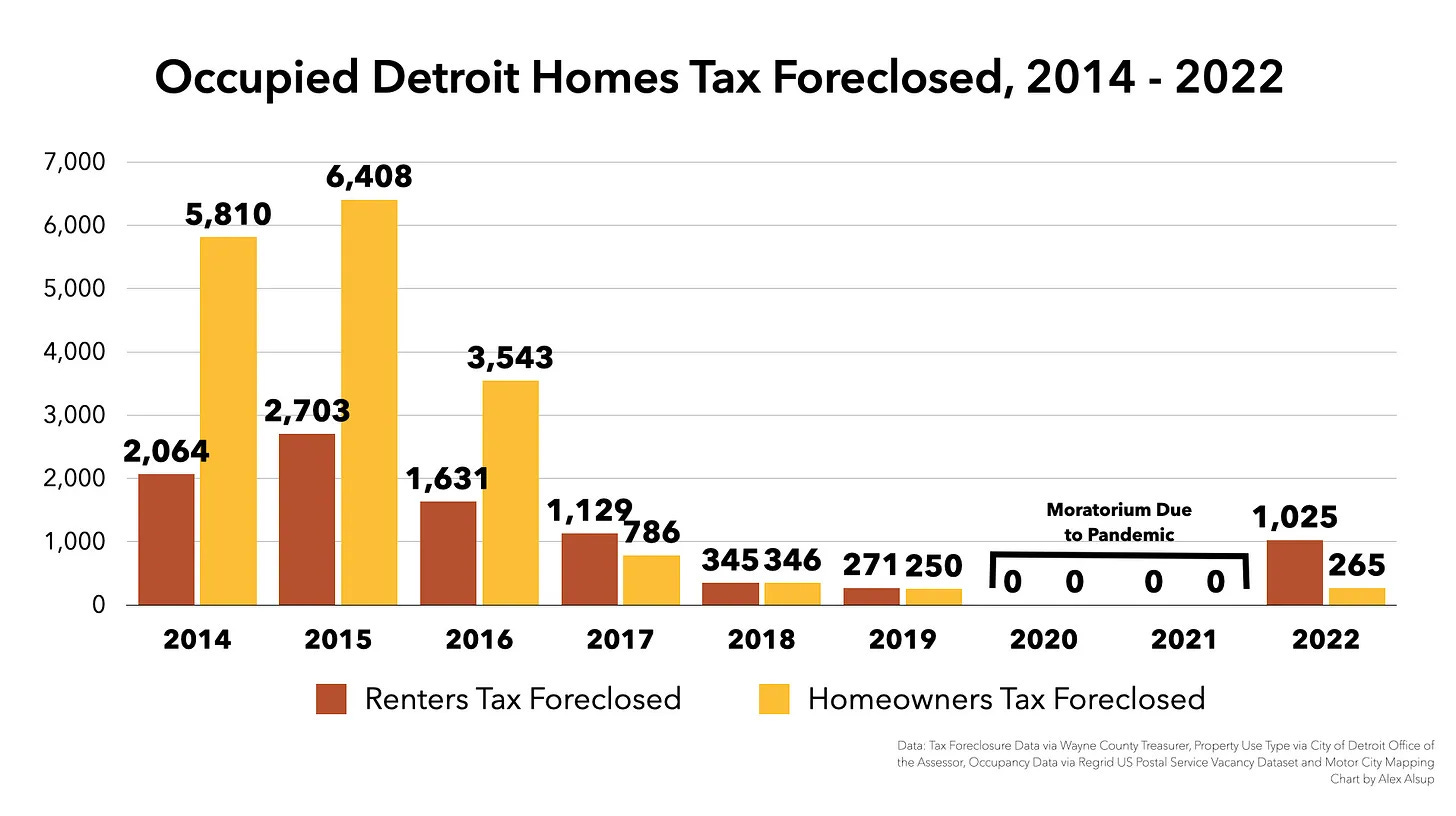

The 2015 tax foreclosure auction was the largest in Wayne County’s history, with more than 25,000 Detroit properties tax foreclosed. If the explosive growth years of the tax foreclosure auctions (2008 - 2015) were going to produce windfall profits on owner occupied homes, we’d see it in 2015 when 6,400 Detroit homeowners lost their homes to tax foreclosure in a single auction.

Using sales data from the 2015 tax auction via Regrid as well as Motor City Mapping data from 2014, I found 4,849 occupied homes (including both owner and renter occupied) sold in the 2015 auction.2

Of those 4,849 occupied homes that sold at auction how many sold for more than their tax debt owed? That’s the condition that must be met to generate windfall profits.

Answer: 642 — just 13%.

Of those 642 homes, 70% were owner occupied and the median windfall profit generated was $4,400.

So we saw 6,400 Detroit homeowners lose their homes in the 2015 auction and, now, nine years later, the Michigan Supreme Court might decide that about 450 of them — if you can even find them — are owed four grand a piece.

$4,000 might be a significant sum of money for some who lost their homes, but it pales in comparison to the value of what was lost, especially considering that the median sale price for a home in Detroit is nearing $100,000.

Is there any chance of a retroactive ruling providing anything like financial “justice” to Detroit homeowners from the massive auction years of 2009 - 2017?

No.

2. Windfall Goes to the Speculators

But what about more recent auction years? As home values rose in Detroit, did more recent auctions produce larger windfall profits on the homes of one-time Detroit homeowners? Let’s look at the 2018 tax auction which was 1/10th the size of the 2015 tax auction, with “just” 2,700 Detroit properties tax foreclosed.

Of the $12.1M in windfall profits generated by the 2018 tax auction, only 11% would be owed to one-time Detroit homeowners. Most would go to former owners outside Detroit ($5.4M total, median of $4,200 in windfall profits) and former landlords ($2.5M total, median of $4,300).

Far fewer occupied homes fell to tax foreclosure by 2018 — just 691 occupied Detroit homes were in the auction that year, evenly split between homeowners and renters. With more interest in Detroit real estate, 65% of those occupied homes sold at auction for more than their tax debt owed, a far higher rate than in 2015.

Still, the median windfall profit generated on the 154 owner-occupied homes that sold at auction for more than the tax debt owed in 2018 was only $5,500 — just 25% higher than the median windfall profit in 2015 despite only 1/10th of the supply at auction and a strengthening real estate market.

Why were auction prices on occupied homes so low? Likely because at this point in the history of tax foreclosure auctions, when tax foreclosure prevention mechanism for homeowners were much stronger, it was only severely distressed owner occupied homes that were making it to auction.

How Speculators Would Profit

A homeowner would have windfall profits on one property. Many speculators and landlords had portfolios of properties foreclosed and, in the event multiple properties generated windfall profits, they would be owed a portfolio’s-worth of windfall profits. Why did these investors frequently have multiple tax foreclosed properties? It was part of their business model.

Here’s a few examples, just from the 2018 auction, of owners outside Detroit (per property tax bill mailing address data circa 2018) with multiple properties foreclosed that generated windfall profits:

An owner in Livonia, MI with nine properties tax foreclosed, cumulative windfall profits of $106,000

An owner in Las Vegas, NV, five properties tax foreclosed, cumulative windfall profits of $73,000

An owner in Dallas, TX, eight properties tax foreclosed, cumulative windfall profits of $53,000

An owner in Pontiac, MI, eight properties tax foreclosed, cumulative windfall profits of $45,000

3. Finding One-Time Homeowners

Landlords, speculators, and outside owners are obviously going to be more motivated (because they’d be owed more money), better resourced, and overall more able to capture windfall profits.

Homeowners will be incredibly difficult to find at this point and far less resourced in recovering windfall profits.

I am also incredibly doubtful that establishing ownership will be a straightforward process for homeowners, especially the farther back you go in auction history. Anyone who’s spent a minute dealing with the connection between the Register of Deed and Treasurer’s Office will know this.

As I have consistently said since the beginning of the Rafaeli case years ago, this series of lawsuits have little to do with justice for those wronged by tax foreclosure.

The profit motive will remain.

A bone to pick with the Detroit News coverage of this story:

Throughout the article, the Detroit News article refers to “homeowners” who lost their properties at auction and whether “homeowners” need to be repaid windfall profits. In no way was the Rafaeli decision limited to homeowners. Owners of ANY type of property are, per the Rafaeli decision, entitled a way to capture windfall profits in the event their (former) property sells at auction for more than the debt owed.

The chart shows the total number of occupied homes that were foreclosed not that necessarily sold at auction — thousands did not sell, as was typical in those major auction years.