Detroit Property Tax Delinquency Ticks Up

Indications of an Increase in Property Tax Delinquency Amongst Detroit Homeowners for the First Time in Years

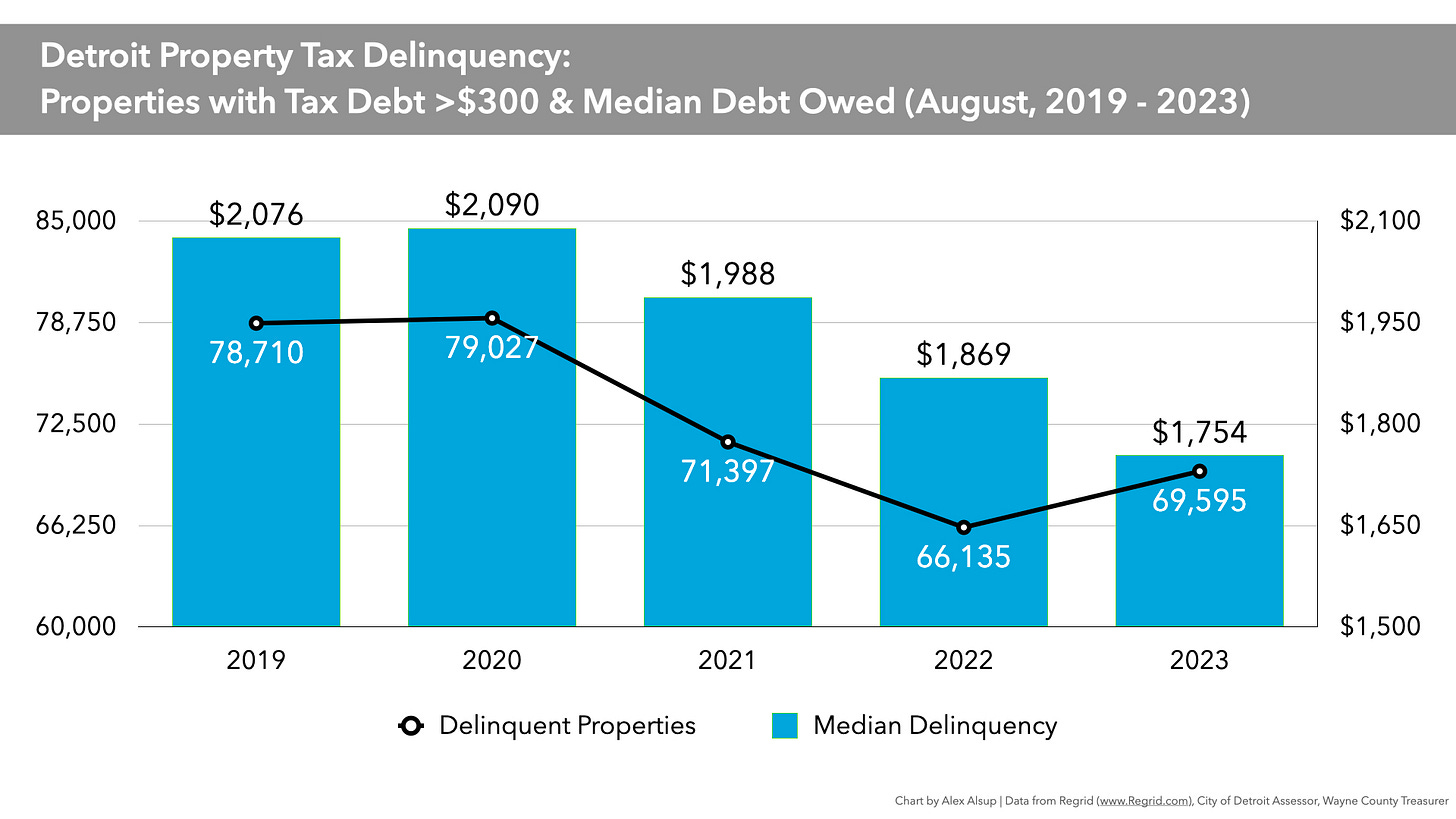

A point-in-time analysis I’ve been working on with Detroit delinquent property tax data from August 2019 - August 2023 shows an increase in tax delinquency for the first time in several years, with a notable increase amongst Detroit homeowners:

The Data

There was a 10% increase in the number of tax delinquent Detroit homeowners as of August 2023 vs. August 2022 — 22,162 homes vs. 20,230.

Note: The chart above includes figures only for properties with more than $300 in property tax debt. Below that amount data is much noisier and less reliable, as non-foreclosable debts like solid waste fees are found by the thousands. Debt in excess of $300, as a rule of thumb, is a more reliable indicator of true property tax delinquency.

This is the first increase in homeowner property tax delinquency I've seen after years of progress had reduced homeowner tax debt to its lowest levels in over a decade.

The 2023 increase was driven both by fewer homeowners exiting delinquency than in the year prior, and by more homeowners becoming newly delinquent than in the year prior.

Data for this analysis consists of delinquent property tax data from the Wayne County Treasurer alongside Detroit assessment data, and US Postal Service vacancy data, all of which has been collected and maintained by Regrid.

Why Does a 10% Increase in Homeowner Delinquency Matter?

An increase of about 2,000 tax delinquent homeowners1 in a city with around 120,000 homeowners may not seem like much, but the dynamics behind the increase are what caught my attention.

The chart below looks at the “churn” in homeowner tax delinquency from August 2019 - August 2023. Take a look and then I’ll unpack what this all means:

In short, between August 2022 and August 2023, fewer tax delinquent homeowners were able to eliminate their delinquency than in recent years, and more homeowners that did not have property tax debt previously, fell into delinquency.

45% fewer homeowners managed to eliminate their tax debt between August 2022 and August 2023 than were able to between August 2021 and August 2022:

3,517 homeowners exited delinquency between August 2022 and August 2023 vs. 6,456 who exited delinquency between August 2021 and August 2022.

Similarly, there was a 57% increase in the number of homeowners who fell into tax delinquency between August 2022 and August 2023 vs. August 2021 to August 2022:

5,449 homeowners became newly tax delinquent between August 2022 and August 2023, compared to 3,460 who became newly delinquent between August 2021 and August 2022.

All of the above reflect the “churn” in the delinquent tax system. By tracking parcel IDs (unique identifiers that every property in Detroit has) it is possible to follow properties from year-to-year and look for changes in their delinquency status.

What is Delinquent Tax “Churn”?

Every March, cities across Michigan turn over their uncollected property taxes from the year prior to their county treasurer (the “Delinquent Transfer”). The three basic tax delinquency state changes that can inform the totals in that transfer are:

Properties that already owed property tax debt, remain delinquent

Properties that owed property tax debt have paid off their debt and are no longer delinquent

Properties that had not owed property tax debt become delinquent

It then takes a few months for the delinquent transfer to kind of “settle down” as low debt amounts and a lot of new delinquency is often paid off quickly and you wait to see how things shake out and what level delinquent property taxes settle at.

Here’s what citywide property tax delinquency looks like across all property types as of August over the last few years:

So, in January of 2023 when I noted the progress eliminating homeowner tax debt, we were still seeing the conditions of the 2022 delinquent transfer and the state of overall delinquency in its wake. Now, after the March 2023 delinquent transfer has likely settled down, there is an indication of a possible change in conditions.

Why is This Happening?

I don’t know. It's too small an increase to attribute to any cause or set of causes, and and one year doesn't equal a trend.

The increase in homeowner delinquency could disappear by this time next year. Maybe, for some unknown reason, homeowner delinquency post-delinquent transfer in 2023 is taking longer to “settle down” and the increase seen as of August will evaporate in the coming months. But the penalties in the tax foreclosure system are strongly weighted against “assuming the best.” Overreaction is always the best bet.

Further, there's no need to understand why this increase in delinquency is happening before doing something about it (and doing something will help answer the "why" part, too).

For the Newly Delinquent Homeowners:

Go knock on the doors. 5,500 homes is nothing to canvass. Ten teams of 2 canvassers / team would knock that out in three weeks under the most conservative of time estimates. Pay canvassers $20 / hour and it would cost $20,000 on the outside. That’s the cost of about 1.3 demolitions. I think you can prevent more than 1.3 demolitions by knocking on the doors of 5,500 newly tax delinquent homeowners!

Has the income profile of these homeowners changed?

Do they attribute their delinquency to some other factor like home repairs?

Has the ownership of these homes changed in a way not reflected in assessment data?

All of the above would be valuable to understand and would give you things to look for in the coming years in order to discern whether the delinquency increase in 2023 is a blip or a trend.

Of particular concern amongst the newly delinquent homeowners owing >$300 is the fact that 1,250 of them (23%) have an “HPTAP” status from the City Assessor, meaning they were granted a property tax exemption in the last year or two. That means these are homeowners who should be applying for property tax exemptions every year and, thus, owing $0 in property taxes. This isn’t a fault of these homeowners as the rhythm and requirements around these exemptions is not well understood. They need outreach and support to re-apply.

For Homeowners who Remain Delinquent Since Last Year:

There are still an unprecedented number of very effective tools to eliminate homeowner tax debt — Pay As You Stay, the Detroit Tax Relief Fund, MIHAF… all can help eliminate the property tax debt for homeowners with low-incomes. I don’t see any reason to think these tools are less applicable to homeowners still in tax delinquency this year than they were last year. But it requires outreach and effort to help homeowners through the bureaucracy and into these programs.

Where Are These Newly Delinquent Homeowners?

There are some notable concentrations of newly tax delinquent homeowners as of August 2023 in northeast Detroit (Osborn and Yorkshire Woods in particular — longtime tax foreclosure hotspots), Bagley and Warrendale on the west side, and Boynton in far southwest Detroit.

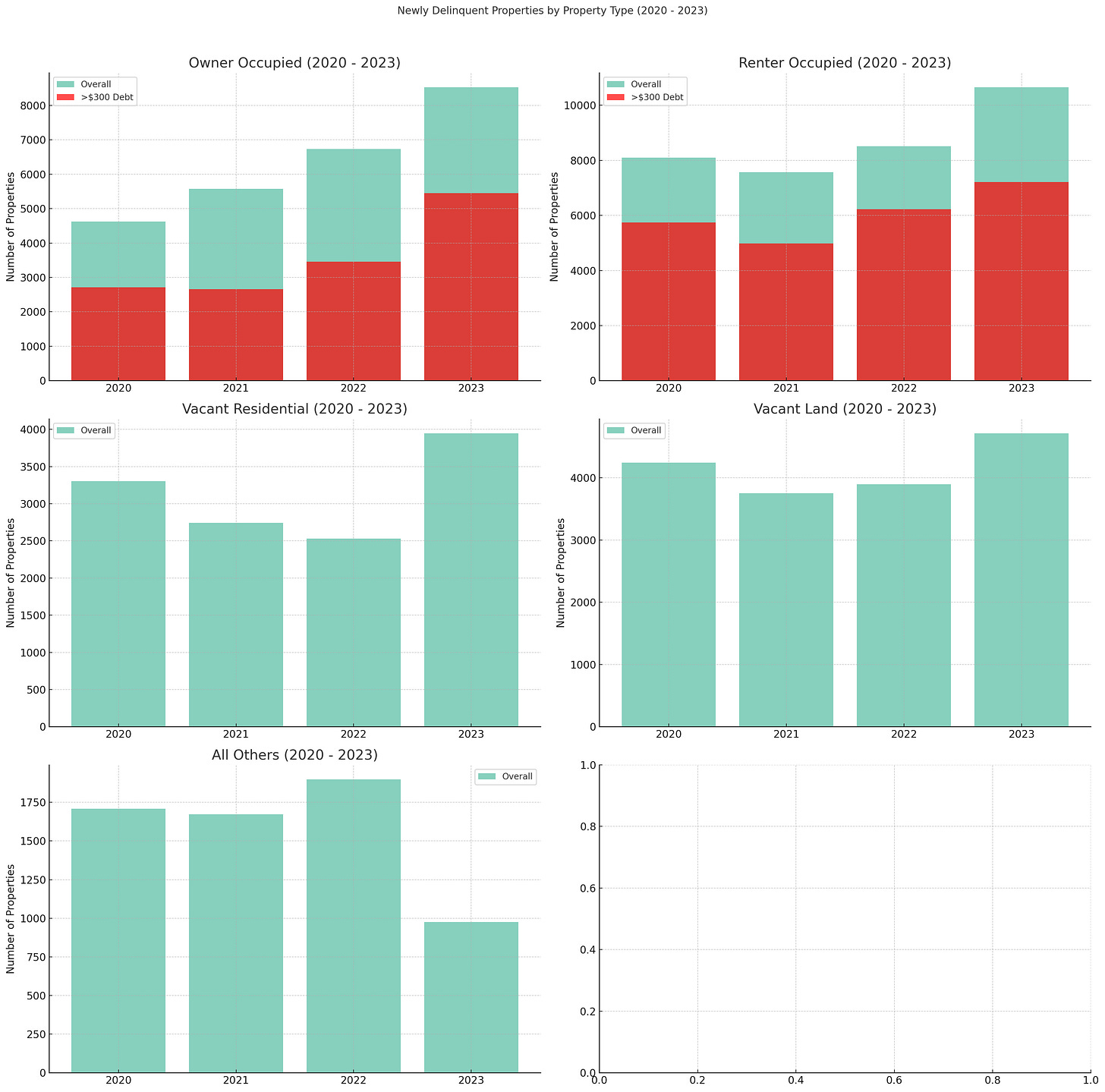

How has Delinquency Changed Amongst Other Types of Property?

The change in newly tax delinquent properties across other types of property in Detroit is not as pronounced as the change for homeowners:

There is some indication of a trend of rising delinquency amongst renter-occupied homes where landlords may be more frequently not paying property taxes, but the totals are lower there. Also, there are not really any interventions to address landlord tax delinquency the way there are for homeowners — most of the options for renter-occupied homes arise at the point of tax foreclosure, not in the midst of delinquency.

I’ll be interested to keep an eye on the increase in newly delinquent vacant homes seen in 2023. If that continues I’d be curious if it reflects some changing calculus on the worthiness of investing in rehabbing / reoccupying vacant homes that we saw amidst the pandemic. But delinquency changes that small amongst vacant homes is definitely something I’d need to see over multiple years to consider terribly meaningful.

“Homeowner” in the context of this analysis is defined in the data as a home that, in the given year mentioned, had a Principal Residence Exemption and was reflected in that year’s US Postal Service vacancy data as Not Vacant.