Michigan's Tax Foreclosure System Heads to the US Supreme Court

Tax Foreclosure on Notice

The US Supreme Court has agreed to hear a tax foreclosure case originating in Michigan. The case, Pung v. Isabella County, represents the most significant challenge to the state’s tax foreclosure system to date, along with other systems like it around the country. It is the latest in a years long string of cases that have challenged Michigan’s foreclosure system, but the first to make the leap outside state lines and land with the Supreme Court.

If the Court rules against Michigan counties in the upcoming case, the financial consequences will be significant. My estimate is that the potential liability for Wayne County alone could fall in the range of $500 million - $750 million. A ruling in favor of Pung could also force substantial revisions to Michigan’s tax foreclosure system, if not a wholesale rethinking.

But the sticker price isn’t the only story — there is also the question of who would pay. Michigan counties don’t actually have the money at question in the Pung case on hand (I’ll explain why later), so the bill will likely be paid out of each county’s Delinquent Tax Revolving Fund (DTRF). These funds are financed, in part, by the 18% interest, penalties, and fees charged to property owners who are behind on their taxes.

If the US Supreme Court rules in favor of Pung, it will likely be residents struggling to pay their taxes and keep their homes who will subsidize payouts to former owners — often investors and speculators — who walked away from theirs.

To understand why, it will help to start with an example:

Red Grape Properties LLC

This small home on Westphalia Street, on Detroit’s east side, was tax foreclosed in 2017. At the time, it was owned by an LLC based in Clarkston, Michigan called Red Grape Properties LLC. The image below, via Google Street View Time Machine, shows what the house looked like shortly after tax foreclosure: boarded up and vacant.

The property was foreclosed by the Wayne County Treasurer’s Office for $4,700 in unpaid property taxes, interest, penalties, and fees. It sold in the 2017 tax foreclosure auction for $5,100.

The first of two questions at stake in Pung v. Isabella County could change the math on how much money the LLC that owned this property can collect as a result of its sale.

The Current Math:

Under current Michigan law, defined by Michigan Supreme Court rulings in Rafaeli v. Oakland County (2020) and Schafer v. Kent County (2024)1, the math on this is simple:

Auction Sale: $5,100

Tax Debt: $4,700

Surplus: $400

Result: The former owner is owed $400

In the Michigan Supreme Court’s ruling in Rafaeli v. Oakland County, the court found that when a property sells in a tax auction for more than the tax debt owed, the former owner is owed the surplus proceeds from the auction. The return of those surplus proceeds represents “just compensation” for the taking of the former owner’s equity by the government.

In Schafer the Court ruled just compensation could be sought retroactively. In practice, this meant retroactive claims could be made back to the 2015 tax auction, per Michigan’s statute of limitations.

The Math Proposed by Pung:

Pung v. Isabella County, however, argues that the auction price is irrelevant. “Just compensation” under the Fifth Amendment, says Pung, must be based on the Fair Market Value at the time of the taking. And, crucially, they lean on the government’s own tax assessment as proof of that value.

The assessed value of this home on Westphalia at the time of tax foreclosure was $15,300. In Michigan, assessed value is set at 50% of market value, so, that would imply a Fair Market Value of $30,600.

If the US Supreme Court rules in favor of Pung, the just compensation math could change to this:

Auction Sale:$5,100(irrelevant)Fair Market Value: $30,600

Tax Debt: $4,700

Result: The Wayne County Treasurer owes Red Grape Properties LLC $25,900.

This is the potential seismic shift: If the Court rules in favor of the plaintiff in Pung, the answer to “what is just compensation?” could change from “the LLC gets a few hundred dollars” to “The County Treasurer owes the LLC $25,900.”

Now, imagine that multiplier applied across tens of thousands of tax foreclosure sales statewide over many years.

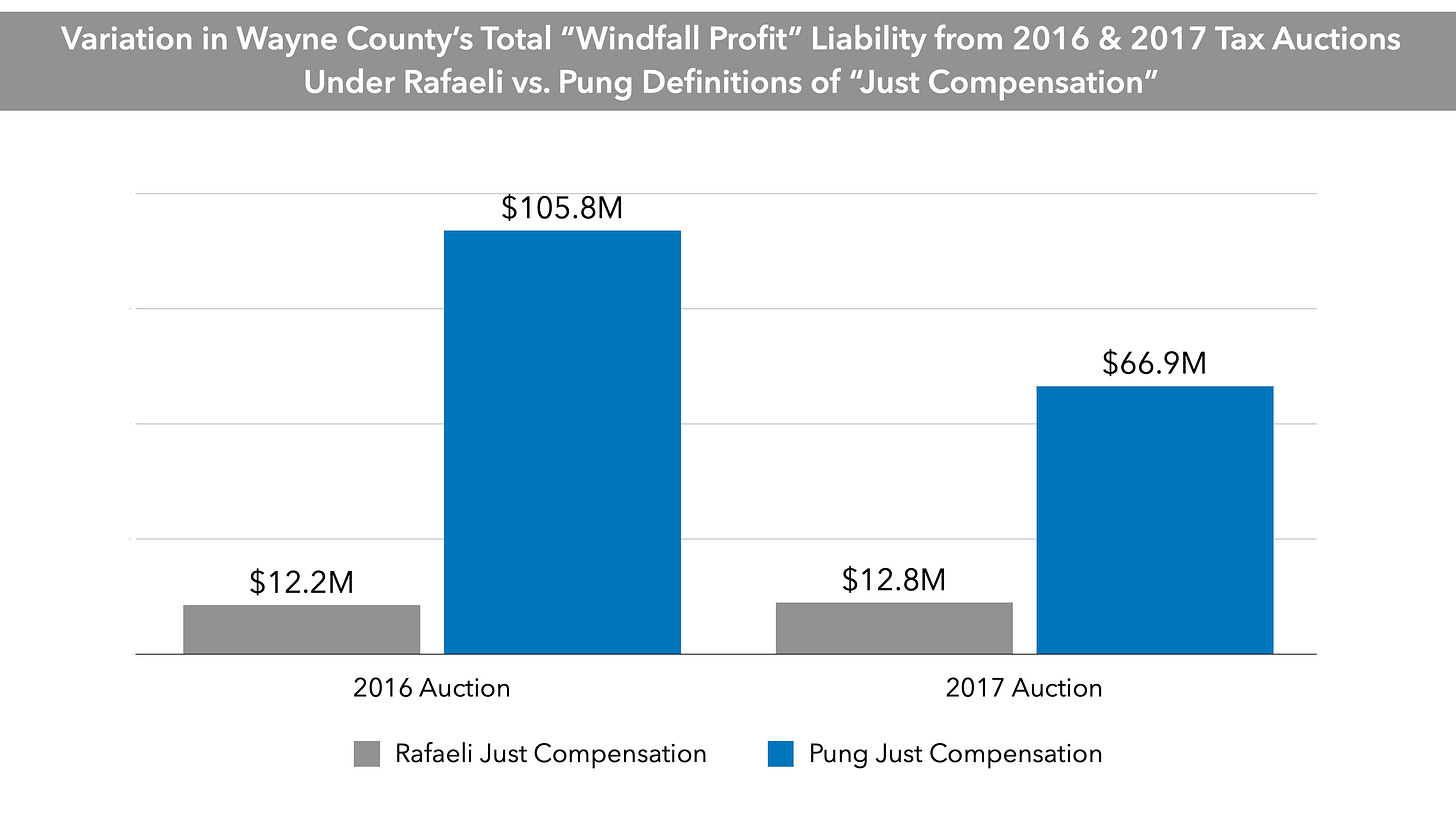

I don’t have assessment data for tax foreclosed properties for all tax auction years in Wayne County (let alone the whole state), but I do for 2016 and 2017. Below is the difference in “just compensation” liability for Wayne County from the 2016 and 2017 tax auctions under the Rafaeli definition of just compensation, versus the Pung definition:

Under current law: Wayne County’s just compensation liability for the 2016 and 2017 auctions combined is about $25 million.

Under the Pung definition: That liability explodes to over $170 million.

If you extrapolate that across all auctions from 2015 to present, assuming the timeframe for retroactivity remains, my ballpark estimate for Wayne County’s total liability is between $500 million and $750 million. That, of course, says nothing about all other counties across Michigan, whose liabilities would be lower but who also do not have tax a base the size of Wayne County’s.

The Questions Posed by Pung

The example above deals with the first of the two simple but highly consequential questions posed in Pung v. Isabella County:

A Fifth Amendment Question: What defines “just compensation” when government takes a property over unpaid taxes? The sale price in a tax auction, or the property’s fair market value at the time of the taking?

An Eighth Amendment Question: Is tax foreclosure an “excessive fine” meant to deter nonpayment of property taxes?

I am going to break this down into a three-part series, because the implications are too large for a single post:

Part 1: What is Just Compensation? Fair market value vs. auction price — and why a Pung win could blow a multi‑hundred‑million‑dollar hole in Michigan county budgets.

Part 2: Is Tax Foreclosure an Excessive Fine? Whether tax foreclosure itself is a punitive forfeiture and how the Supreme Court’s answer could require a reimagining of Michigan’s tax foreclosure system.

Part 3: My takeaways across both questions and what could be next for Michigan’s tax foreclosure system.

I’ve written about these tax foreclosure cases for years, warning that none of them will produce much in the way of positive outcomes for the actual victims of the tax foreclosure system, that the rulings largely benefit speculators, and all leave intact the true source of profit for Michigan county government in the tax foreclosure system — the 18% interest charged on delinquent property taxes. Pung doesn’t change that—if anything, it sharpens the contradiction.

Part 1: What is Just Compensation?

The dollar amount in the Westphalia Street example above isn’t remotely an outlier. The fair market value of properties in tax auctions (at least when based on assessed value) was often — and can still be — substantially higher than the prices at which tax foreclosed properties sell.

In fact, in the case before the US Supreme Court, the dollar amounts are far higher. Here’s how Pung’s particular just compensation argument plays out, step by step:

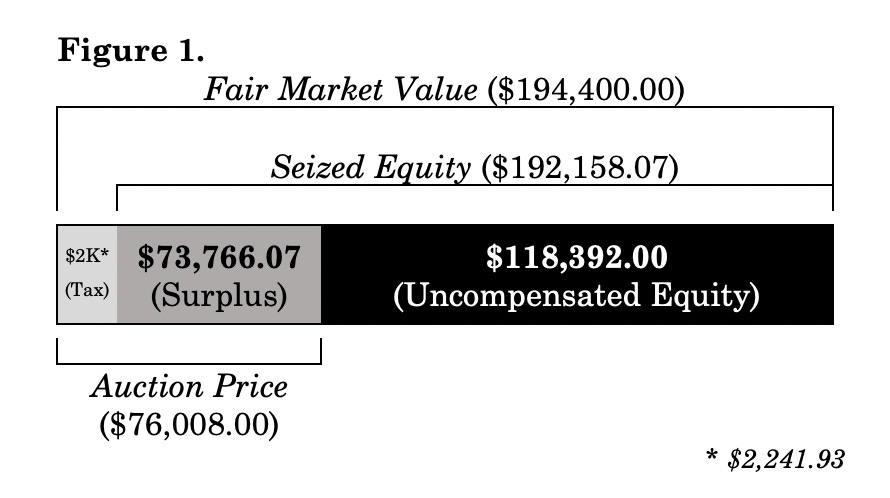

Pung lost their property over $2,241.93 in unpaid property taxes.

The Pung home sold in an Isabella County tax foreclosure auction for $76,008.

Pung’s estate recovered the “windfall profits” of $73,766.07 but then sued, claiming those windfall profits were not sufficient, and that just compensation should be based on the fair market value of the home.

Pung pointed to the assessor’s valuation of $194,400 at the time of foreclosure as the indication of fair market value.

The Pung estate is seeking an additional $118,392 in “uncompensated equity” represented by the difference between the sale price at auction, and the assessment at the time of foreclosure which, again, they claim is indicative of fair market value.

The rationale for Pung’s definition leans on previous US Supreme Court rulings. As summarized in their petition:

“Just Compensation” under the Fifth Amendment consists of “the total value of the property when taken” plus “interest from that time.” Knick v. Twp. of Scott, 588 U.S. 180, 190 (2019).

This isn’t coming out of nowhere. In Tyler v. Hennepin County (2023), the Supreme Court unanimously ruled that a county commits a taking when it seizes a home for taxes and keeps the owner’s equity beyond the tax debt owed. However, the Court left open whether “just compensation” in these tax foreclosure cases should be pegged to the auction surplus, to fair market value, or to something else — that is the question Pung is squarely taking on.

Pung characterizes the tax auction price as an “artificially depressed” measure of “total value” rather than fair market value. It’s easy to see why: tax auctions are distressed sales. The market is flooded with thousands of properties simultaneously, there is minimal marketing, and the purchase window is limited. Not an ideal set of conditions to maximize sale prices.

In Pung’s framing, the fair market value is indicated by the county’s own assessed value of the property: $194,400 at the time of foreclosure. Under Michigan’s property tax system, the assessed value drives the property tax bill, and the Michigan Constitution caps assessed value at 50% of market value. Meanwhile, the General Property Tax Act requires assessments to be set at 50% of “true cash value”. Put together, assessments in Michigan are supposed to be a 50%-of-fair-market-value statement. Pung is trying to hold them to it.

I think Michigan counties and their treasurers are in trouble.

I don’t see how the US Supreme Court rules against Pung on this Fifth Amendment question. Between that and the fact the Michigan Supreme Court already ruled just compensation can be sought retroactively back to 2015, the financial implications of the Pung ruling for Michigan counties could be serious, as previously discussed.

The Devils in the Details

There are three critical nuances, however, that turn the financial implications in the Pung case from a simple constitutional question into a procedural minefield:

1. Defining Fair Market Value

Even if the Supreme Court agrees with Pung that “just compensation” must be measured by Fair Market Value (FMV), the Court might not define how to calculate FMV.

Pung is leaning on the government’s own assessed value (x2) as the proxy for FMV. It makes sense why they’d do this. Establishing retroactive FMV for thousands of properties via individual appraisals would be tremendously complicated. By pointing to the assessment, Pung seems to be trying to trap the government in its own logic: If you said the house was worth $194,000 when you taxed it, you cannot claim it was worth only $76,000 when you took it.2

However, if the Supreme Court rules that FMV is the standard but declines to bless the “assessment proxy” as the method, it could create a chaotic scenario where thousands of back-dated appraisals are required to prove damages.

2. Detroit’s Assessments vs. Reality

Zooming out from Pung’s specific facts, using assessments as a FMV proxy creates its own problems in places like Detroit.

In Detroit (the source of about 60% of Michigan’s tax foreclosures in the 2010s) assessments up until roughly 2020 were notoriously disconnected from actual market conditions. I’ve long argued that, in the first half of the 2010s, tax auction sale prices in Detroit probably were far closer to FMV than anything in the tax roll.

So, if counties want to push back on using assessments as evidence of FMV, they’ll need to say the quiet part out loud: that in places like Detroit, the City’s own assessment practices were so disconnected from reality that they can’t be used as a fair-market benchmark.

At a minimum, that’s an awkward coordination problem between the City and the County Treasurer — entities that don’t share the same interests here — and potentially one with implications that extend beyond the Pung case.

3. Who Actually Tries to Collect and How

This leads to the most perverse outcome. If the Supreme Court agrees with Pung on the Fair Market Value question but rejects the assessment formula, the victory may become worthless for the average tax-foreclosed former homeowner. We know this because the U.S. Court of Appeals for the Sixth Circuit recently warned us.

In Bowles v. Sabree, the Court rejected a class action strategy based on Fair Market Value, ruling that while “surplus proceeds” derived from auction sale prices are easy to calculate on a spreadsheet, FMV is an individualized nightmare. As the Court wrote:

“The district court denied class certification... We affirmed because determining the fair market value of each potential class member’s property — no easy task, even for experts — would have led to difficulties figuring out class membership and would have undercut the ‘efficiencies and ease of administration that might otherwise favor classwide resolution.’”

If Pung wins on the principle of FMV but fails to lock in a formulaic way to calculate it (like assessments), it could effectively kill the class action vehicle.

The result could be that well-resourced commercial owners, speculators, and investors will be able to hire appraisers and lawyers to litigate their six-figure claims one by one. But the homeowner who lost a $20,000 property will be left with a theoretical constitutional right to Fair Market Value, but no real way to afford the fight to collect it.

In other words, the Court could create a constitutional right that scales with the size of the loss: the bigger and more sophisticated you are, the more real your remedy becomes.

Who Pays The Bill?

As I mentioned at the beginning of this piece, the critical difference in the definition of “just compensation” between Rafaeli and Pung is that, in the Pung equation, the County does not possess the money the plaintiff is asking for. If a home sells for $76,000 but the court orders a $194,000 payout, the county is in a $118,000 deficit.

Legally, I’m pretty sure that’s irrelevant: “The question is what has the owner lost, not what has the taker gained.” (Boston Chamber of Commerce v. Boston, 1910). The fact that the County didn’t collect the fair market value of a property doesn’t matter. They still have to pay.

In Michigan, I suspect the first source of funds for these payouts will be the county treasurers’ Delinquent Tax Revolving Funds (DTRF). These funds are used to pay municipalities their expected tax revenue while the County collects on bad debts. The DTRF is primarily funded by two things:

Windfall profits at tax auctions when properties sell for more than the tax debt owed. (Now curtailed)

Property owners who make payments on the punitive 18% interest rate charged on delinquent taxes in order to keep their homes and properties.

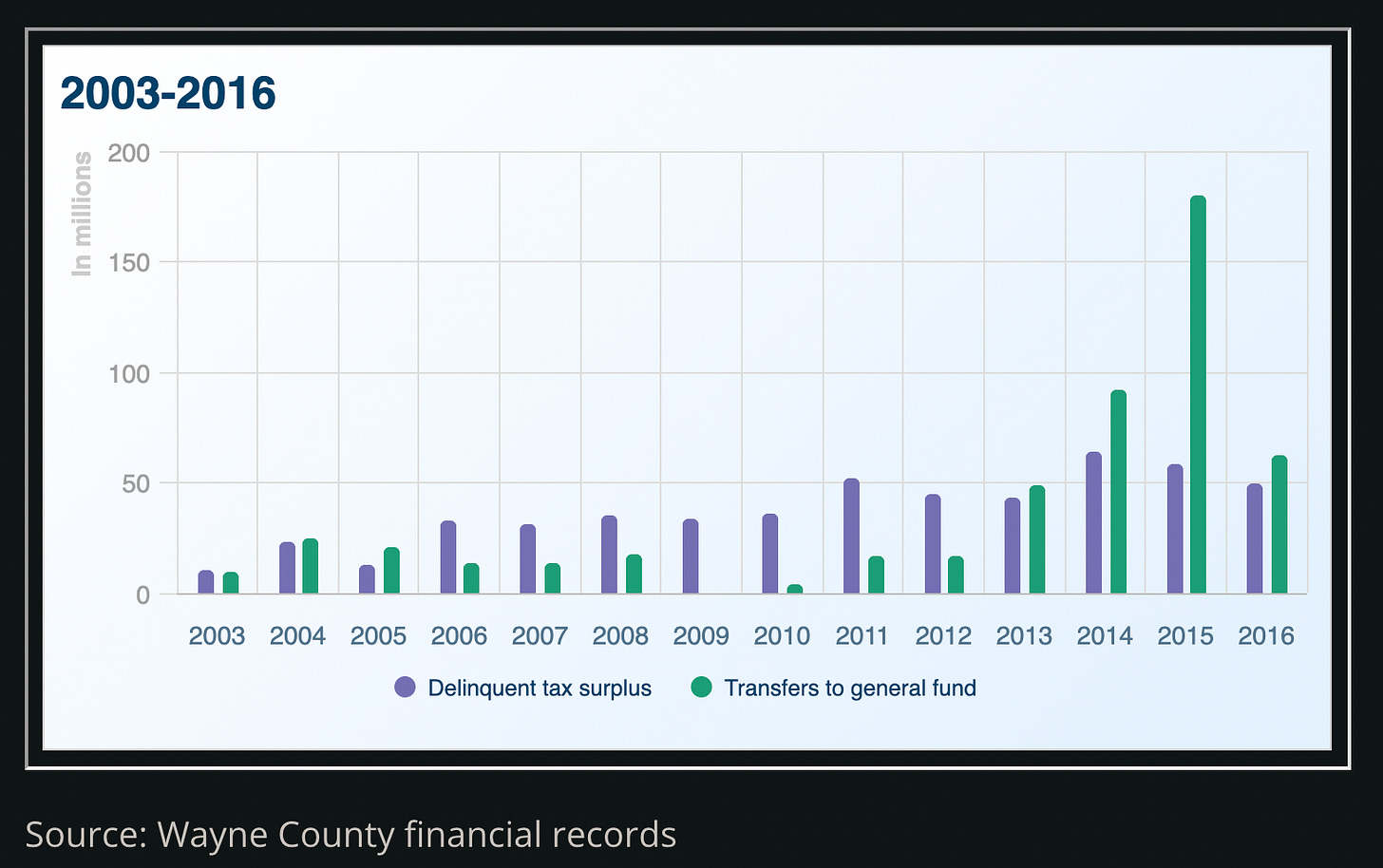

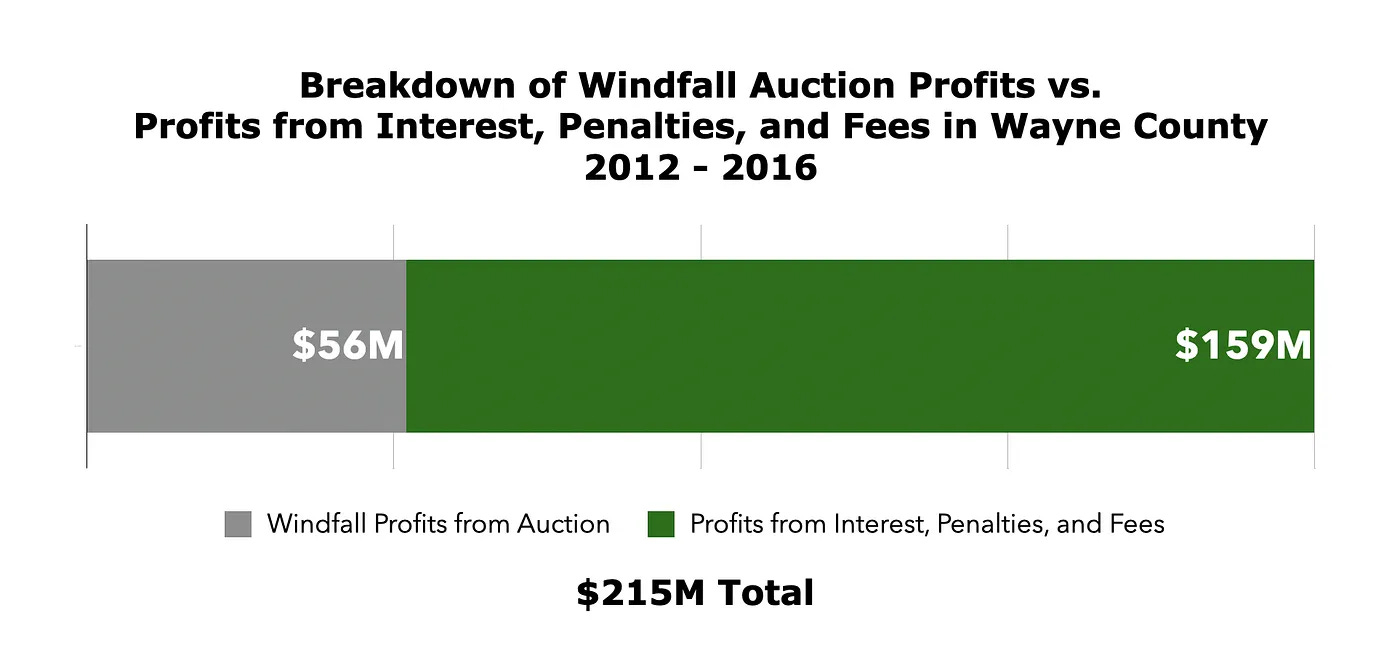

It is the latter that has produced the vast majority of profits in the tax foreclosure system for Wayne County, and I’m quite sure that is the case statewide as well. I’ve previously analyzed tax delinquency and foreclosure profits in Wayne County between 2012 - 2016. I found that nearly 75% of profits generated in those years came from interest payments on delinquent taxes, not profits from tax auction sales:

This is the reality of the justice being sought in the Pung case: DTRFs, mechanisms funded by people currently struggling to keep their properties, may need to be drained to pay “fair market value” settlements to former owners3. In many cases, like the home on Westphalia, those former owners are LLCs and speculators who often made a business decision to abandon the property.

During the Rafaeli case, attorneys from the Pacific Legal Foundation, who represented Rafaeli in front of the Michigan Supreme Court, argued that finding in favor of Rafaeli would “remove that perverse incentive for government to be foreclosing over an $8 debt.”

At the time I said that this misdiagnosed the problem. The real “perverse incentive” had never been foreclosing and making a killing at the auction — it was not foreclosing, and keeping people on the hook, rolling delinquent balances forward at 18% interest year after year to do things like support Wayne County’s general fund with massive transfers out of the DTRF.

Now these cases, which all trace their lineage back to Rafaeli v. Oakland County, have finally come full circle. In the name of eliminating one supposed perverse incentive (profiting off auction windfalls), they will likely create another: a system in which people trying to keep their homes end up subsidizing payouts to speculators who walked away from theirs.

If Pung wins, we aren’t correcting past abuses. We are raising the constitutional price of tax enforcement to a level that may break the system entirely.

And reinforced by the US Supreme Court ruling in Tyler v. Hennepin County (2023) which considered the same question, but within Minnesota’s tax foreclosure system.

In Pung’s case, that argument is particularly sharp because the property was immediately resold for roughly that same number, making the assessment look less like bureaucracy and more like a real market signal. From the petition in Pung:

“After the tax auction, the property speculator who purchased the property immediately turned around and sold it for $195,000.”

How many counties’ DTRFs even have enough money in them to satisfy these potential claims is a separate question. If they don’t dipping into general funds and bond issues could be required.

Unless you're claiming the auction was fixed, how do you get off claiming it doesn't result in fmv? Tax Auctions aren't surprises, they are known to the public, etc.

The market value was impacted by the owner through letting it fall into tax foreclosure. Bidders at auction bid lower that for other homes because they assume there's something wrong with such properties. Bidders generally assume that if there wasn't something wrong with such homes, they would have been sold through normal channels.

The owner, effectively, lowered their own fmv by letting the home fall into tax foreclosure, end of story.

Wow. Can you imagine not doing any of the work to sell your property, not paying your taxes, then telling the government they should give you the full amount of what your property might have sold for if you had actually done the work of selling your own property?

Maybe the takings clause should be limited to the improvement value of the house, since the land is a communal asset being fenced as private property.