How to Restart a Tax Foreclosure Crisis

Amidst a tragedy caused by homelessness, Detroit may let a critical tool against tax foreclosure expire without a fight

In February, two young children experiencing homelessness froze to death while sleeping in their mother's van parked inside a Detroit casino garage. The tragedy prompted Detroit Mayor Mike Duggan to order a comprehensive review of how the city coordinates homeless services.

Events like these point to an iceberg problem: a mountain of underlying policy failures — or non-existent policies — culminating in highly visible suffering. Yet the City’s response (so far, a 7-point plan that resulted from the City’s review of homelessness services) focuses on immediate symptoms. Critical underlying causes, like tax foreclosure — which was displacing thousands of Detroiters annually just a few years ago — are omitted. As a result, a major opportunity to meaningfully prevent homelessness is being overlooked.

While I know of no evidence to suggest that the recent tragedy was caused by tax foreclosure, homelessness of course often results directly from policies that force families out of their homes. Any comprehensive review of homelessness should examine these upstream causes, chief amongst them Michigan’s property tax foreclosure system.

We've made tremendous progress over the past five or six years to shut down tax foreclosure as an avenue to homelessness for Detroit’s poorest homeowners. Stories like these have disappeared:

A clear chance to make sure we preserve this progress and do not return to the devastating waves of tax foreclosure from the 2010s rests on the upcoming renewal of Pay As You Stay.

On July 1st, 2025, Michigan's "Pay As You Stay" (PAYS) law will expire unless it is renewed legislatively. Initially passed in 2020 with Duggan's support, PAYS significantly reduces property tax debt owed by homeowners in poverty who apply for and receive the City of Detroit’s Homeowners Property Tax Exemption, known as “HOPE”.

Rather than championing an extension of PAYS, especially in light of the recent tragedy, Mayor Duggan and city hall have been notably silent about its renewal. As a result, the pipeline from homeowner to homeless for the city’s poorest residents may reopen.

How Detroit Escaped the Grip of Tax Foreclosure: HOPE → PAYS → DTRF

While PAYS is a statewide law, cities in Michigan can decide individually whether to participate. Detroit homeowners have been the greatest beneficiaries due to the deliberate development and use of three interconnected programs:

Homeowners Property Tax Exemption (HOPE): The City of Detroit’s property tax exemption for homeowners in poverty which eliminates the current year’s property taxes.1

Pay As You Stay (PAYS): Reduces property tax debt typically by 50-70% for homeowners granted HOPE exemptions (if they owe delinquent property taxes).

Detroit Tax Relief Fund (DTRF): A philanthropic initiative funded by the Gilbert Family Foundation which pays off all remaining property tax debt for homeowners who are enrolled in PAYS.

In practice, the HOPE exemption automatically triggers PAYS (reducing tax debt) and the DTRF (paying off whatever debt is not eliminated by PAYS), creating a fully retroactive property tax exemption system2.

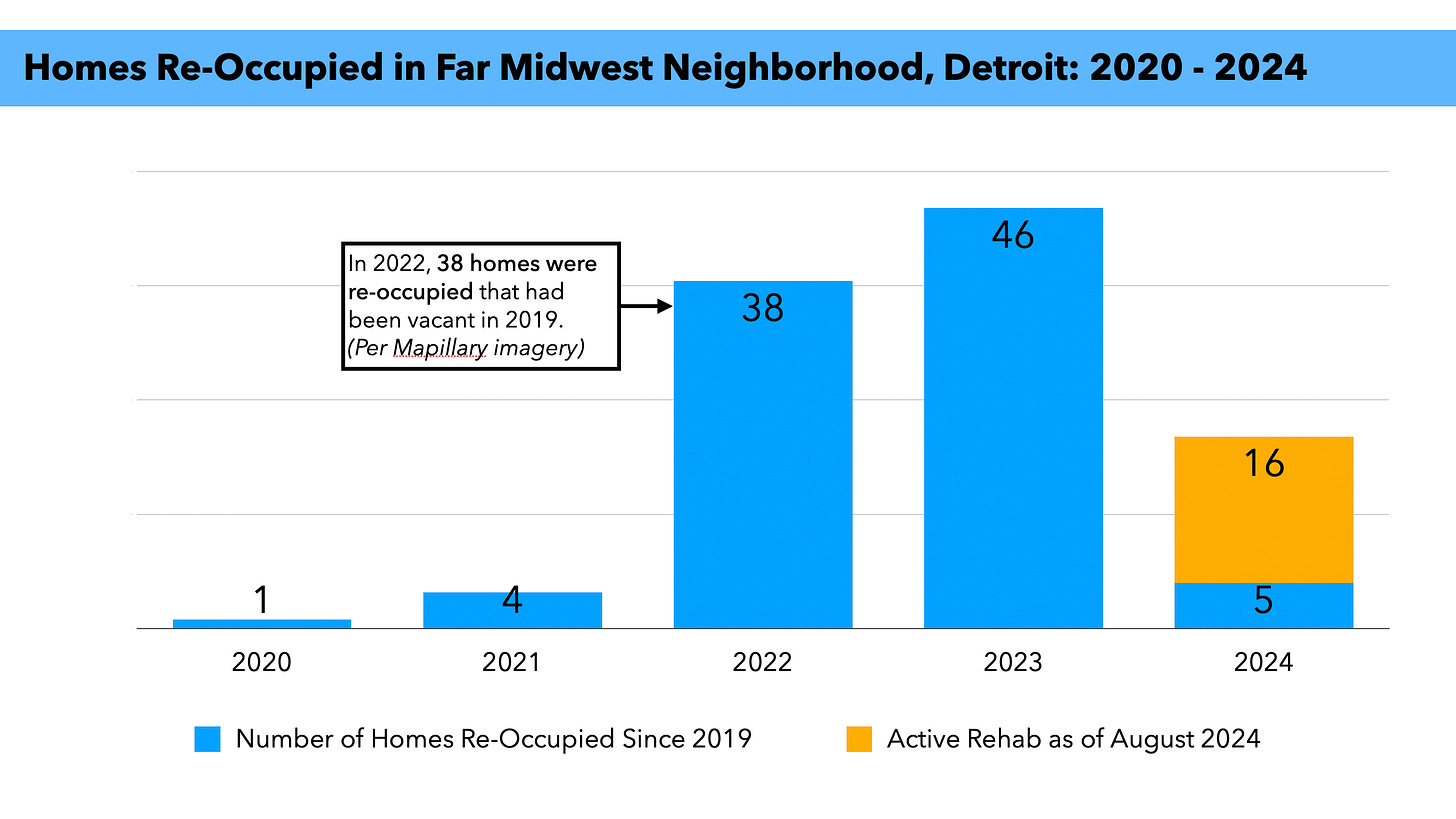

Together, these policies significantly reduced tax foreclosure risk and the spiral into homelessness for Detroit’s poorest homeowners, as shown in the chart above. Between 2020 and 2024, ~750 homeowners lost their homes to tax foreclosure — a stark contrast to the 6,400 homeowners foreclosed upon in 2015 alone, prior to these programs3.

Not only have these programs nearly ended homeowner tax foreclosures, they have also eliminated mountains of property tax debt, which is what puts homeowners at risk of tax foreclosure in the first place. There is no meaningful tax foreclosure prevention for homeowners in poverty without the elimination of property tax debt.4 This is debt homeowners in poverty never should have owed because they qualified for (previously inaccessible) HOPE exemptions.

Since the advent of the HOPE + PAYS + DTRF trio, not only is tax foreclosure preventable but that mountain of homeowner tax debt is being erased. Based on my analysis with data from 2019 through part of 2024, HOPE + PAYS + DTRF have together eliminated at least $60 million in Detroit homeowner tax debt across at least 16,000 owner occupied homes.

These initiatives have been unprecedented in their ability to free homeowners from previously insurmountable property tax burdens.

The Rising Risk of Backsliding

And yet, recent data shows troubling signs of some erosion, even with the powerful trio of programs, HOPE, PAYS, and DTRF:

A point-in-time comparison from January 15 of 2020 - 2025 shows that the number of Detroit homeowners with >2 years of delinquent property taxes — meaning imminent tax foreclosure risk — jumped from 6,300 in 2024 to 8,400 in 2025. This is the first increase in years.

Among these 8,400 homeowners at risk of tax foreclosure, 2,500 previously benefited from debt elimination from the combination of HOPE → PAYS → DTRF, but are again accumulating tax debt. PAYS currently prohibits repeat participation, leaving these homeowners without protections despite ongoing poverty.

Collectively, those 2,500 homes owed $14.5M in tax debt prior to having their debt eliminated by PAYS and the DTRF. Today, they’ve accumulated $6.8M in new tax debt. This is a tragic waste of hard won progress and points to serious danger for the families in these homes.

While an increase of 2,500 homeowners facing tax foreclosure may not seem like a large jump, once tax delinquency starts to build it doesn’t just reverse course on its own. Absent intervention, I guarantee the number of homeowners subject to foreclosure (whether they previously participated in PAYS or not) will be higher again next year, and the year after that…

This does not mean that PAYS is ineffectual — far from it.

Were it not for HOPE → PAYS → DTRF we would never have achieved the reduction in homeowner tax debt and foreclosures in the first place. The fact that 2,500 homeowners slid back into tax foreclosure risk indicates an absence of ongoing communication and outreach around the administration of these programs.

Despite improvements in the application process, HOPE remains poorly understood and many homeowners do not understand the requirement to reapply annually. During the pandemic, for example, HOPE exemptions were automatically carried over from one year to the next without need for reapplication. That benefit has since expired.

Additionally, outreach efforts to enroll homeowners in HOPE and conduct targeted follow-up after debt elimination have been evidently ineffective or non-existent. Common-sense reforms (such as automatic renewal of HOPE until financial circumstances change) have not been lobbied for.

What's At Stake if PAYS Expires?

If PAYS sunsets this July, the linchpin in the trio of programs that have been eliminating tax debt and preventing homeowner tax foreclosures will disappear. Without it, tax debt will accumulate with no chance for escape. This risks unraveling years of meaningful progress in stabilizing neighborhoods and preserving homeownership.

Mayor Duggan, who initially championed PAYS — alongside Wayne County Executive Warren Evans and Wayne County Treasurer Eric Sabree, whose support is also crucial — now appears prepared to let it expire without advocacy. Allowing PAYS to lapse risks setting the stage for resurgent tax foreclosures that could easily follow him beyond Detroit, should he be successful in his independent gubernatorial bid. Tax foreclosure is a statewide system, after all.

Avoiding the Iceberg

The recent deaths caused by homelessness make plain the urgent need for upstream policy solutions rather than merely crisis response. Yet, in the entirety of the 773 page 2026-2029 budget presented by the mayor the other day, neither tax foreclosure nor PAYS are mentioned once.

Mayor Duggan’s previous advocacy for structural solutions like a land value tax prove he understands systemic thinking in the property tax realm. He needs to translate that understanding into action by:

Lobbying to make Pay As You Stay permanent. And, if he becomes governor, he should make it mandatory statewide as well.

Advocating for automatic HOPE exemption renewals to remove unnecessary administrative barriers.

Mayor Duggan, Wayne County officials including County Executive Warren Evans and County Treasurer Eric Sabree, Detroit residents, and policymakers across Michigan face a critical choice: either advocate for the renewal and expansion of PAYS, preserving a proven tool to fight tax foreclosure—or allow it to expire, risking renewed foreclosures, homelessness, and preventable tragedies.

The evidence, outcomes, and human stakes couldn’t be clearer. Detroit cannot afford to reverse its progress. Pay As You Stay must be extended.

There are also partial exemptions offered via HOPE, but in practice the vast majority of HOPE recipients qualify for 100% exemptions.

I worked on the development of the DTRF and the weaving together of these three programs while at the Rocket Community Fund.

I have previously estimated that between 2008 - 2016 around 30,000 Detroit homeowners lost their homes to tax foreclosure. For the vast majority of these, they likely qualified for HOPE exemptions — which at the time were so difficult to apply for most homeowners didn’t even know they existed.

Prior to PAYS in 2020, homeowner tax foreclosures had declined for a couple years, but their underlying tax debt had actually increased. That’s because poorly conceived delinquent tax payment plans — while temporarily forestalling foreclosure between 2016 - 2019 — allowed debt to continue piling up in the background. Without PAYS, the expiration of those payment plans (which gave homeowners 5 years to pay off their debt at reduced interest rates) would have led to a new wave of foreclosures.